SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

| Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

Mutual Fund Series Trust

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person (s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| o | Fee paid previously with preliminary materials: |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Catalyst/SMH Total Return Income Fund

a series of

Mutual Fund Series Trust

4221 North 203rd Street, Suite 100

Elkhorn, Nebraska 68022

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held [_____ __],June 4, 2024

Dear Shareholders:

The Board of Trustees of Mutual Fund Series Trust, an open-end management investment company organized as an Ohio business trust, has called a special meeting of the shareholders of Catalyst/SMH Total Return Income Fund (the “Fund”) to be held at the offices of Thompson Hine LLP, 41 South High Street, Columbus, OH 43215, on [_____ __],June 4, 2024, at 10:00 a.m., Eastern time, for the following purposes:

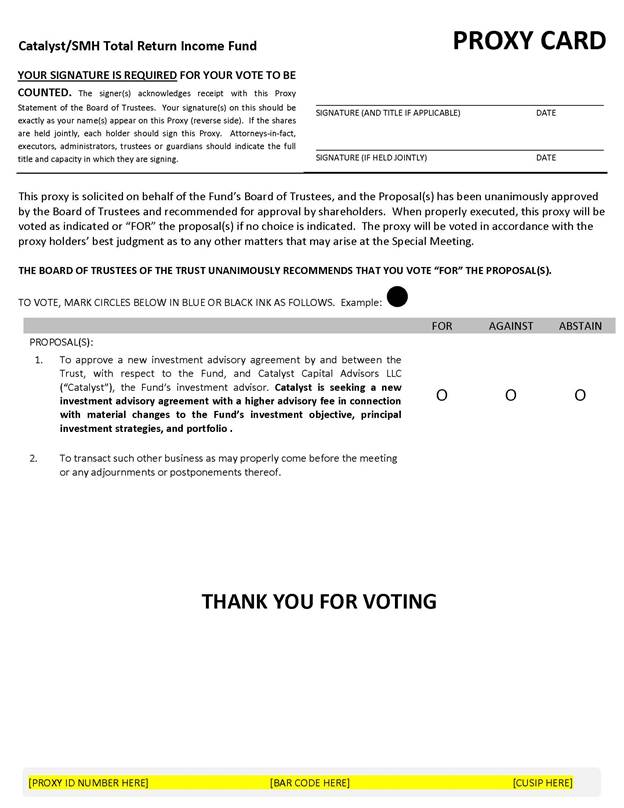

| 1. | To approve a new investment advisory agreement with Catalyst Capital Advisors LLC (“Catalyst”), the Fund’s investment advisor (“Catalyst”). Catalyst is seeking a new investment advisory agreement with a higher advisory fee in connection with material changes to the Fund’s investment objective, principal investment strategies, and portfolio management. |

| 2. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Shareholders of record at the close of business on [_____ __],April 16, 2024, are entitled to notice of, and to vote at, the special meeting and any adjournments or postponements thereof. The Notice of Meeting, Proxy Statement, and accompanying form of proxy will be mailed to shareholders on or about [____ __],April 30, 2024.

By Order of the Board of Trustees

Michael Schoonover, President

[____ __],April 26, 2024

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON [____ __],JUNE 4, 2024.

A copy of the Notice of Shareholder Meeting, the Proxy Statement (including the proposed Investment Advisory Agreement) and Proxy Voting Ballot are available at

[INSERT WEBPAGE LINK]

HTTPS://VOTE.PROXYONLINE.COM/CATALYST/DOCS/PROXY.PDF

YOUR VOTE IS IMPORTANT

To assure your representation at the meeting and your vote is counted, please: (i) complete the enclosed proxy and return it in the accompanying envelope so that it is received by the date set by the financial intermediary through which you own shares of the Fund or, if no such date is set, by the beginning of the meeting; or (ii) call the number listed on your proxy card before the meeting whether or not you expect to be present at the meeting. If you attend the meeting, you may revoke your proxy and vote your shares in person.

Catalyst/SMH Total Return Income Fund

a series of

Mutual Fund Series Trust

with its principal offices at

4221 North 203rd Street, Suite 100

Elkhorn, Nebraska 68022

____________

PROXY STATEMENT

____________

SPECIAL MEETING OF SHAREHOLDERS

To Be Held [____ __],June 4, 2024

____________

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board”) of Mutual Fund Series Trust (the “Trust”) on behalf of Catalyst/SMH Total Return Income Fund (the “Fund”), for use at a special meeting of shareholders of the Trust (the “Meeting”) to be held at the offices of Thompson Hine LLP, 41 South High Street, Columbus, OH 43215, on [____ __],June 4, 2024, at 10:00 a.m. Eastern time, and at any and all adjournments thereof. The Notice of Meeting, Proxy Statement, and accompanying form of proxy will be mailed to shareholders on or about [____ __],June 4, 2024.

The Board has called the Meeting for the following purposes:

| 1. | To approve a new investment advisory agreement with Catalyst Capital Advisors LLC (“Catalyst”), the Fund’s investment advisor (“Catalyst”). Under the new advisory agreement, Catalyst is seeking a higher advisory fee in connection with material changes to the Fund’s investment objective and principal investment strategies. |

| 2. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Only shareholders of record at the close of business on [____ __],June 4, 2024 (the “Record Date”), are entitled to notice of, and to vote at, the Meeting and any adjournments or postponements thereof.

The Fund’s most recent annual report, including financial statements and schedules, is available at no charge by visiting www.catalystmf.com.com,.com, sending a written request to the Fund, 4221 North 203rd Street, Suite 100 Elkhorn, NE 68022, or calling toll-free 1-855-552-4596.1-866-447-4228.

| 1 |

OVERVIEW AND BACKGROUND

The Fund currently seeks income and capital appreciation by investing primarily in a broad range of income-producing securities. These include equity securities, such as dividend-paying common stocks and REITS, and debt securities, such as interest-paying bonds and convertible bonds. Under the oversight of Catalyst, the Fund’s sub-advisor, SMH Capital Advisors, LLC (“SMHCA”) seeks to invest in attractively valued securities that, in its opinion, represent above-average long-term investment opportunities.

At a meeting on February 27, 2024, the Board considered a recommendation from Catalyst to amend the Fund’s objective and principal investment strategies in an attempt to increase the Fund’s returns with the potential of generating higher monthly distributions to the Fund’s shareholders. Under the revised strategy, the Fund would seek income and long-term capital appreciation by combining a portfolio investing primarily in a broad range of income-producing securities with a swap overlay that provides exposure to yield-oriented quantitative investment strategies (i.e., a strategy that is uncorrelated to the Fund’s direct investments in fixed income securities but intended to generate income).

Catalyst explained to the Board that under the recommended strategy, Catalyst would enter structured notes and/or swap agreements on the Fund’s behalf and manage the collateral related thereto. It further explained that SMHCA would continue to invest the remainder of the Fund’s assets as it always has in a broad range of income-producing securities. In connection with the revised strategy, Catalyst also recommended changing the Fund’s name to “Catalyst Systematic High Income Fund.” The Board determined that these recommendations were in the best interests of the Fund’s shareholders and approved changing the Fund’s investment objective and revising the Fund’s investment strategy.

While the types of services offered by Catalyst and SMHCA to the Fund are not affected by the revised strategy, Catalyst noted that executing the recommended strategy and, particularly, implementing the swap overlay, would require an increased level of services from Catalyst. In order to compensate Catalyst for their increased level of services, Catalyst is seeking an increase in its advisory fee from 1.00% to 1.75% of the Fund’s average daily net assets. If shareholders do not approve Proposal I, Catalyst and SMHCA will not implement the proposed strategy.

PROPOSAL I

APPROVAL OF A NEW INVESTMENT ADVISORY AGREEMENT

WITH CATALYST CAPITAL ADVISORS LLC

Section 15(c) of the Investment Company Act of 1940, as amended, requires that investment advisory agreements be approved by a vote of a majority of the outstanding shares of the Fund. The Board requests that the Fund’s shareholders approve a new Investment Advisory Agreement with Catalyst (the “New Advisory Agreement”). Under the New Advisory Agreement, the advisory fee for the Fund will increase from 1.00% of the Fund’s average daily net assets to 1.75% of the Fund’s average daily net assets. Catalyst explained to the Board that the higher advisory fee is intended to compensate Catalyst for the increased costs associated with implementing the overlay strategy.

| 2 |

The Investment Advisory Agreement

In addition to the increased advisory fee, the New Advisory Agreement differs from the current advisory agreement in that the New Advisory Agreement is titled “Investment Advisory Agreement” and updates all references to the “investment manager” and “management fee” to “investment adviser” and “advisory fee,” respectively, as well as Catalyst’s current address and the Trust’s current name. The New Advisory Agreement specifies that any notice required under the agreement shall be sent by first class or express mail, courier, or email in lieu mail postage prepaid and updates the addresses to which such notices should be sent. The New Advisory Agreement extends the period under which Catalyst is to provide a written report to the Board describing any issues that have arisen under its code of ethics from 45 days to 60 days from the last calendar quarter end of each year while the New Advisory Agreement is in effect. The term and date of effectiveness are also revised and other non-material grammatical errors are corrected.

The New Advisory Agreement further clarifies that the Fund, and not Catalyst, will pay any compensation and expenses of any officers and trustees of the Trust. Currently, no compensation is owed to any officer or trustee who is an officer, director, member or employee of Catalyst or its affiliates other than the Trust’s Chief Compliance Officer. Under the current advisory agreement, the Fund pays the compensation and expenses of the Trust’s Chief Compliance Officer, regardless of whether such officer is affiliated with Catalyst, and no other officer, director, member or employee of Catalyst or its affiliates. Therefore, this clarification, in effect, does not change any of the Fund’s obligations. The New Advisory Agreement also specifies that expenses of regulatory examinations fall within the definition of “extraordinary or non-recurring expenses” which are borne by the Fund.

In all other material respects, the New Advisory Agreement remains the same as the current advisory agreement. All services offered under the current advisory agreement are offered under the New Advisory Agreement. Both the current advisory agreement and the New Advisory Agreement provide that Catalyst will continuously furnish an investment program for the Fund, make investment decisions on behalf of the Fund, and place all orders for the purchase and sale of portfolio securities, subject to the Fund’s investment objectives, policies, and restrictions and such policies as the Board may determine.

Like the current advisory agreement, the New Advisory Agreement will have an initial term of two years, and continues from year to year thereafter, only so long as its continuance is approved at least annually by: (i) the Board; or (ii) a vote of a majority of the outstanding voting securities of the Fund, provided that in either event, continuance is also approved by a majority of the Trustees who are not “interested persons” (as defined in the 1940 Act) of the Trust (the “Independent Trustees”) by a vote cast in person at a meeting called for the purpose of voting such approval. Both the current advisory agreement and the New Advisory Agreement automatically terminate on assignment and are terminable on 60 days’ written notice by the Board or Catalyst. Both the current advisory agreement and the New Advisory Agreement provide that Catalyst shall not be subject to any liability in connection with the performance of its services thereunder in the absence of willful misfeasance, bad faith, gross negligence or reckless disregard of its obligations and duties.

| 3 |

The following table provides information about the advisory fees earned by and paid to Catalyst with respect to the Fund for each of the last three fiscal years ended June 30.

| 2021 | 2022 | 2023 | |

| Total Advisory Fee | $158,157 | $208,416 | $168,738 |

| Waiver | $92,056 | $83,714 | $100,308 |

| Net Advisory Fee | $66,101 | $124,702 | $68,430 |

TheIf the New Advisory Agreement is approved by shareholders, it will become effective as of [the date of shareholder approval].on the same day that the Fund’s Prospectus with the revised strategy is effective. If the New Advisory Agreement is not approved by shareholders, the Board and Catalyst will consider other options, including a new or modified request for shareholder approval of a new advisory agreement. Catalyst and SMCHA will not implement the recommended revised strategy for the Fund if shareholders do not approve the New Advisory Agreement.

The description in this Proxy Statement of the New Advisory Agreement is only a summary. The New Advisory Agreement, with the proposed fee schedule, is attached hereto as Exhibit A. You should read the New Advisory Agreement and the proposed fee schedule.

Current and Pro Forma Fees and Expenses of the Fund

The following tables describes the fees and expenses of Class A, Class C, and Class I shares of the Fund that you may pay if you buy, hold and sell shares of the Fund, and the Fund’s pro forma fees and expenses, assuming shareholder approval of the New Advisory Fee. Other Expenses and Acquired Fund Fees and Expenses are based on amounts the Fund incurred during fiscal year ended June 30, 2023.

Current Fees and Expenses

| Shareholder Fees (fees paid directly from your investment) | Class A | Class C | Class I |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | 5.75% | None | None |

| Maximum Deferred Sales Charge (Load) (as a % of the original purchase price) | 1.00%1 | None | None |

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends and other Distributions | None | None | None |

| Redemption Fee | None | None | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||

| Management Fees | 1.00% | 1.00% | 1.00% |

| Distribution and/or Service (12b-1) Fees | 0.25% | 1.00% | 0.00% |

| Other Expenses | 0.93% | 0.93% | 0.93% |

| Interest Expense | 0.01% | 0.01% | 0.01% |

| Remaining Other Expenses | 0.92% | 0.92% | 0.92% |

| Acquired Fund Fees and Expenses2 | 0.01% | 0.01% | 0.01% |

| Total Annual Fund Operating Expenses | 2.19% | 2.94% | 1.94% |

| Fee Waiver and/or Expense Reimbursement3 | (0.59)% | (0.59)% | (0.59)% |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 1.60% | 2.35% | 1.35% |

| Shareholder Fees (fees paid directly from your investment) | Class A | Class C | Class I |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | 5.75% | None | None |

| Maximum Deferred Sales Charge (Load) (as a % of the original purchase price) | 1.00%1 | None | None |

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends and other Distributions | None | None | None |

| Redemption Fee | None | None | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||

| Management Fees | 1.00% | 1.00% | 1.00% |

| Distribution and/or Service (12b-1) Fees | 0.25% | 1.00% | 0.00% |

| Other Expenses | 0.93% | 0.93% | 0.93% |

| Interest Expense | 0.01% | 0.01% | 0.01% |

| Remaining Other Expenses | 0.92% | 0.92% | 0.92% |

| 4 |

| Acquired Fund Fees and Expenses2 | 0.87% | 0.87% | 0.87% |

| Total Annual Fund Operating Expenses | 3.05% | 3.80% | 2.80% |

| Fee Waiver and/or Expense Reimbursement3 | (0.59)% | (0.59)% | (0.59)% |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 2.46% | 3.21% | 2.21% |

Pro Forma Fees and Expenses

| Shareholder Fees (fees paid directly from your investment) | Class A | Class C | Class I | Class A | Class C | Class I |

Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | 5.75% | None | 5.75% | None | ||

| Maximum Deferred Sales Charge (Load) (as a % of the original purchase price) | 1.00%1 | None | 1.00%1 | None | ||

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends and other Distributions | None | None | ||||

| Redemption Fee | None | None | ||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||

| Management Fees | 1.75% | 1.75% | ||||

| Distribution and/or Service (12b-1) Fees | 0.25% | 1.00% | 0.00% | 0.25% | 1.00% | 0.00% |

| Other Expenses | 0.93% | 0.93% | ||||

| Interest Expense | 0.01% | 0.01% | ||||

| Remaining Other Expenses | 0.92% | 0.92% | ||||

| Acquired Fund Fees and Expenses2 | 0.01% | 0.87% | ||||

| Total Annual Fund Operating Expenses | 2.94% | 3.69% | 2.69% | 3.80% | 4.55% | 3.55% |

| Fee Waiver and/or Expense Reimbursement4 | (0.68)% | (0.68)% | ||||

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 2.26% | 3.01% | 2.01% | 3.12% | 3.87% | 2.87% |

1 The 1.00% maximum deferred sales charge may be assessed in the case of investments at or above the $1 million breakpoint (where you do not pay an initial sales charge) on shares redeemed within two years of purchase.

2 Acquired Fund Fees and Expenses are the indirect costs of investing in other investment companies. The total annual fund operating expenses in this fee table will not correlate to the expense ratio in the Fund’s financial highlights because the financial statements include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in other investment companies.

3 Catalyst has contractually agreed to waive management fees and/or reimburse expenses of the Fund to the extent necessary to limit operating expenses (excluding brokerage costs; borrowing costs such as (a) interest and (b) dividends on securities sold short; taxes; underlying fund expenses; and extraordinary expenses, such as regulatory inquiry and litigation expenses) at 1.58%, 2.33%, and 1.33% for Class A shares, Class C shares, and Class I shares, respectively, through October 31, 2024. This agreement may be terminated by the Board only on 60 days’ written notice to Catalyst, by Catalyst with

| 5 |

the consent of the Board, or upon the termination of the investment advisory agreement between the Trust and Catalyst. Fee waivers and expense reimbursements are subject to possible recoupment by Catalyst from the Fund in future years on a rolling three-year basis (within the three years after the fees have been waived or reimbursed) so long as such 2 recoupment does not cause the Fund’s expense ratio (after the repayment is taken into account) to exceed the lesser of: (i) the Fund’s expense limitation at

the time such expenses were waived and (ii) the Fund’s current expense limitation at the time of recoupment.

4 Catalyst has contractually agreed to waive management fees and/or reimburse expenses of the Fund to the extent necessary to limit operating expenses (excluding brokerage costs; borrowing costs such as (a) interest and (b) dividends on securities sold short; taxes; underlying fund expenses; and extraordinary expenses, such as regulatory inquiry and litigation expenses) at 2.24%, 2.99%, and 1.99% for Class A shares, Class C shares, and Class I shares, respectively, through October 31, 2026. This agreement may be terminated by the Board only on 60 days’ written notice to Catalyst, by Catalyst with the consent of the Board, or upon the termination of the investment advisory agreement between the Trust and Catalyst. Fee waivers and expense reimbursements are subject to possible recoupment by Catalyst from the Fund in future years on a rolling three-year basis (within the three years after the fees have been waived or reimbursed) so long as such 2 recoupment does not cause the Fund’s expense ratio (after the repayment is taken into account) to exceed the lesser of: (i) the Fund’s expense limitation at the time such expenses were waived and (ii) the Fund’s current expense limitation at the time of recoupment.

Current Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then hold or redeem all of your shares at the end of those periods. The Example only accounts for the Fund’s expense limitation in place through its expiration period, October 31, 2024, and then depicts the Fund’s total annual expenses thereafter. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| YEAR | Class A | Class C | Class I | Class A | Class C | Class I |

| 1 | $728 | $238 | $137 | $810 | $324 | $224 |

| 3 | $1,167 | $854 | $552 | $1,411 | $1,107 | $812 |

| 5 | $1,631 | $1,496 | $992 | $2,036 | $1,909 | $1,427 |

| 10 | $2,910 | $3,220 | $2,217 | $3,707 | $3,999 | $3,086 |

Pro Forma Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then hold or redeem all of your shares at the end of those periods. The Example only accounts for the Fund’s expense limitation for its initial period and then depicts the Fund’s total annual expenses thereafter. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 6 |

| YEAR | Class A | Class C | Class I |

| 1 | $872 | $389 | $290 |

| 3 | $1,548 | $1,249 | $959 |

| 5 | $2,310 | $2,188 | $1,721 |

| 10 | $4,295 | $4,573 | $3,726 |

The changes to the Fund’s fees and expenses are expected to become effective on the effective date of the New Advisory Agreement.

The Advisor

Catalyst is a New York limited liability company located at 53 Palmeras St., Suite 601, San Juan, PR 00901. Catalyst was formed on January 24, 2006. Providing investment advisory services to the Catalyst Funds is currently its primary business. Catalyst is under common control with AlphaCentric Advisors LLC (“AlphaCentric”) and Rational Advisors, Inc. (“Rational”), the investment advisors of other funds in the same group of investment companies also known as a “Fund Complex.” Information regarding the funds in the Fund Complex can be found at http://intelligentalts.com. MFund Services, LLC, an affiliate of the Advisor provides the Fund with management, legal administrative and compliance services.

The names, addresses, and principal occupations of the principal executive officers of Catalyst as of the date of this Proxy Statement are set forth below, as well as their positions with the Trust, if any:

| Name and Address* | Principal Occupation | Position with the Trust |

| Jerry Szilagyi | Managing Member, President, and Chief Executive Officer | Trustee and Chairman of the Board |

| David Miller | Chief Investment Officer | None |

| Michael Schoonover | Chief Operating Officer (“COO”) | President |

| Robert Glass | Chief Compliance Officer | None |

* The address of each principal executive officer of Catalyst is in care of Catalyst Capital Advisors LLC, 53 Palmeras Street, Suite 601, San Juan PR 00901.

The following table sets forth the names, addresses, and principal occupations of the Trust’s officers who are also directors, officers, or employees of Catalyst or its affiliates.

| Name and Address | Position with the Trust | Principal Occupation |

| Michael Schoonover* | President | COO, Catalyst, Rational, AlphaCentric, Catalyst International Advisors LLC, MFund Management LLC, and Insights Media LLC; President, MFund Distributors |

| Alex Merino* | Vice President | Investment Operations Manager, MFund Management LLC |

| 7 |

| Frederick J. Schmidt** | Chief Compliance Officer | Director of Compliance Services, MFund Services LLC (“MFund”) |

| Jennifer A. Bailey** | Secretary | Director of Legal Services, MFund |

* Mr. Schoonover’s and Mr. Merino’s address is 53 Palmeras St., Suite 601, San Juan, PR 00901.

** Mr. Schmidt’s and Ms. Bailey’s address is 36 N. New York Avenue, Huntington, NY 11743.

Other Agreements

Expense Limitation Agreement

Currently, Catalyst has contractually agreed to waive management fees and/or reimburse expenses of the Fund to the extent necessary to limit operating expenses (excluding brokerage costs; borrowing costs such as (a) interest and (b) dividends on securities sold short; taxes; underlying fund expenses; and extraordinary expenses, such as regulatory inquiry and litigation expenses) at 1.58%, 2.33%, and 1.33% for Class A shares, Class C shares, and Class I shares, respectively, through October 31, 2024. This agreement may be terminated by the Board only on 60 days’ written notice to Catalyst, by Catalyst with the consent of the Board, or upon the termination of the current advisory agreement.

Under an interim Expense Limitation Agreement, and ifIf Fund shareholders approve the New Advisory Agreement, Catalyst has contractually agreed to waive management fees and/or reimburse expenses of the Fund to the extent necessary to limit operating expenses (excluding brokerage costs; borrowing costs such as (a) interest and (b) dividends on securities sold short; taxes; underlying fund expenses; and extraordinary expenses, such as regulatory inquiry and litigation expenses) at 2.24%, 2.99%, 2.99%, 1.99% and 1.99% for Class A, Class C, Class C-1, Class I and Class T shares, respectively, for two years after the effective date of the New Advisory Agreement. Only Class A, Class C and Class I shares are currently available for purchase. This agreement may be terminated by the Board only on 60 days’ written notice to Catalyst, by Catalyst with the consent of the Board, or upon the termination of the New Advisory Agreement.

Fee waivers and expense reimbursements are subject to possible recoupment by Catalyst from the Fund in future years on a rolling three-year basis (within the three years after the fees have been waived or reimbursed) so long as such recoupment does not cause the Fund’s expense ratio (after the repayment is taken into account) to exceed the lesser of (i) the Fund’s expense limitation at the time such expenses were waived and (ii) the Fund’s current expense limitation at the time of recoupment, and the repayment is approved by the Board.

Sub-Advisory Agreement

Pursuant to the terms of an exemptive order that the Trust received from the U.S. Securities and Exchange Commission (the “SEC”) on January 13, 2014 (the “Order”), Catalyst may hire or replace investment sub-advisers and to make changes to existing sub-advisory agreements with the approval of the Board without obtaining shareholder approval. The Order requires that each sub-adviser be an “investment adviser” as defined in Section 2(a)(20)(B) of the Investment Company Act of 1940, as amended (“1940 Act”) and registered as an investment adviser under the Investment

| 8 |

Advisers Act of 1940 (“Advisers Act”) or not subject to such registration. Under the conditions of the Order, the Board must provide notice to shareholders within ninety (90) days of hiring a new sub-adviser or implementing any material change in a sub-advisory agreement. The Trust may rely on the Order provided the Fund is managed by the Catalyst (or any entity controlling, controlled by or

under common control with the Catalyst) and complies with the terms and conditions set forth in the application for the Order.

At a meeting held on February 27, 2024, the Board considered and approved a new sub-advisory agreement (the “New Sub-Advisory Agreement”) between Catalyst and the Fund’s existing sub-advisor, SMH Capital Advisors LLC (“SMHCA”). The New Sub-Advisory Agreement will be effective when the prospectus for the Fund with the revised investment strategy is effective.

Under the terms of the current sub-advisory agreement, SMHCA is entitled to receive an annual fee from Catalyst of 50% of the net advisory fee Catalyst receives from the Fund (maximum of 0.50% of the Fund’s average daily net assets). The net advisory fee is defined as advisory fees less fee waivers due to any expense caps and any extraordinary expenses related to the management and sponsorship of the Fund, including but not limited to, regulatory, litigation and legal expenses as recorded on the financial statements of the Fund and Catalyst. Under the New Sub-Advisory Agreement, SMH will continue to receive an annual fee from Catalyst of 50% of the net advisory fees that Catalyst receives from Fund on assets invested in the Fund prior to the date of the New Sub-Advisory Agreement and 28.57% of the net advisory fees that Catalyst receives from the Fund on assets received after the date of the New Sub-Advisory Agreement. For such compensation, SMHCA will, at its expense, continuously furnish an investment program for the Fund, make investment decisions on behalf of the Fund, and place all orders for the purchase and sale of portfolio securities and other investments, subject to the Fund's investment objectives, policies, and restrictions and such policies as the Board determines.

Both the current sub-advisory agreement and the New Sub-Advisory Agreement provide that it will continue in force for an initial period of two years, and from year to year thereafter, but only so long as its continuance is approved at least annually by the Board at a meeting called for that purpose or by the vote of a majority of the outstanding shares of the Fund. Like the current sub-advisory agreement, the New Sub-Advisory Agreement will automatically terminate on assignment and can be terminated without the payment of any penalty by the Board, the Catalyst, or vote of a majority of the outstanding shares of the Fund, on 60 days' notice. Both the current sub-advisory agreement and the New Sub-Advisory Agreement can be terminated by SMHCA without the payment of any penalty on 90 days’ notice to Catalyst and the Trust.

Like the current sub-advisory agreement, the New Sub-Advisory Agreement provides that neither SMHCA nor its shareholders, members, officers, directors, employees, agents, control persons or affiliates of any thereof, shall be liable for any error of judgment or mistake of law or for any loss suffered by the Fund in connection with the matters to which the New Sub-Advisory Agreement relates except a loss resulting from a breach of fiduciary duty with respect to the receipt of compensation for services (in which case any award of damages shall be limited to the period and the amount set forth in Section 36(b)(3) of the 1940 Act) or a loss resulting from willful misfeasance, bad faith or gross negligence in the performance of duties or from reckless disregard of obligations and duties under the New Sub-Advisory Agreement.

| 9 |

The New Sub-Advisory Agreement is attached as Appendix B. You should read the New Sub-Advisory Agreement. The description in this Information Statement of the New Sub-Advisory Agreement is only a summary.

SMH Capital Advisors, LLC is a Texas corporation and registered investment advisor located at 4200 S. Hulen Street, Suite 534, Fort Worth, Texas 76109. SMHCA is an investment management firm serving institutions and individuals. In addition to serving as a sub-advisor, SMHCA serves high net worth individuals, pension and profit-sharing plans and charitable organizations. Subject to Catalyst’s oversight and approval, SMHCA is responsible for making investment decisions and executing portfolio transactions for the Fund. In addition, SMHCA is responsible for maintaining certain transaction and compliance related records of the Fund. As compensation for the sub-advisory services it provides to the Fund, Catalyst pays SMHCA 50% of the advisory fees that Catalyst receives from the Fund. The sub-advisory fees payable to SMHCA are paid solely by Catalyst and are not an expense to the Fund.

The names, titles, addresses, and principal occupations of certain principal executive officers and directors of SMHCA are as follows:

| Name and Address* | Title and Principal Occupation |

| Dwayne Moyers | President |

| Lisa Haley | Vice-President |

* c/o SMH Capital Advisors, LLC, 4200 S. Hulen Street, Suite 534, Fort Worth, TX 76109.

Evaluation by the Board of Trustees

At its Meeting on February 27, 2024, the Board considered the approval of the New Advisory Agreement. The Board relied on the advice of independent legal counsel and its own business judgment in determining the material factors to be considered in evaluating the New Advisory Agreement and the weight to be given to each factor. The conclusions reached by the Board were based on an evaluation of all of the information provided and were not the result of any single factor. Moreover, each Trustee may have afforded different weight to the various factors in reaching conclusions with respect to the New Advisory Agreement.

Nature, Extent and Quality of Services. The Board noted that it has a substantial amount of experience with Catalyst as the advisor to a number of other funds in the Trust. The Board stated that it is familiar with the experience and abilities of the Catalyst personnel that would service the Fund. The Board discussed that Catalyst had a good working relationship with the sub-advisor and that Catalyst would review and analyze the Fund’s portfolio and manage the overlay component of the Fund’s strategy. The Board noted Catalyst had experience managing overlay strategies like the proposed investment strategy for the Fund. The Board discussed Catalyst’s risk management team and the effectiveness of Catalyst’s compliance program and recognized that Catalyst had taken significant steps to enhance its cybersecurity protocols and resiliency over the past several years. The Board determined that Catalyst had the ability to provide high quality services to the Fund and its shareholders.

| 10 |

Performance. The Board observed that a fund managed by Catalyst with a comparable strategy slightly trailed the benchmark index for the 1-year period but outperformed the index for the 3 and 5-year periods. The Board concluded that Catalyst had potential to provide satisfactory results.

Fees and Expenses. The Board observed that the proposed advisory fee of 1.75% was higher than the Fund’s current advisory fee. The Board acknowledged Catalyst’s explanation that proposed advisory fee was higher because of the specialized alternative nature of the revised strategy for the Fund, including that the Fund would implement an alternative strategy and a traditional asset allocation strategy within the same fund. The Board noted that the advisory fee was above the median and average fee for the peer group and Morningstar categories but was below the high for each. The Board observed that the expense ratio was above the median and average for both peer group and Morningstar categories but was below the high for each. The Board concluded that the proposed advisory fee was not unreasonable.

Profitability. The Board reviewed the profitability analysis provided by Catalyst and noted that Catalyst anticipated a reasonable profit in year 1 and a higher, but similarly reasonable profit in year 2 in connection with advising the Fund. After discussion, the Board agreed that the projected profits were not excessive.

Economies of Scale. The Board discussed the potential for breakpoints and whether Catalyst would benefit from economies of scale with respect to management of the Fund. The Board recognized that Catalyst did not anticipate reaching the asset levels that it would benefit from economies of scale within the first two years. The Board agreed to revisit the issue as the Fund’s asset levels increased.

Conclusion. Having requested and received such information from Catalyst as the Board believed to be reasonably necessary to evaluate the advisory agreement, and as assisted by the advice of counsel, the Board concluded that the fee structure was reasonable, and that approval of the advisory agreement was in the best interests of the shareholders of the Fund.

At its meeting on February 27, 2024, the Board considered the approval of the New Sub-Advisory Agreement. The Board relied on the advice of independent legal counsel and its own business judgment in determining the material factors to be considered in evaluating the New Sub-Advisory Agreement and the weight to be given to each factor. The conclusions reached by the Board were based on an evaluation of all of the information provided and were not the result of any single factor. Moreover, each Trustee may have afforded different weight to the various factors in reaching conclusions with respect to the New Sub-Advisory Agreement.

Nature, Extent and Quality of Services. The Board is familiar with and has experience with SMH as a sub-advisor for the Fund and another fund in the Trust. The Board noted that SMH would provide investment advisory services, including security research, analysis and portfolio management, for the fixed income component of the Fund. The Board observed that SMH utilized a three-part investment risk mitigation process which historically helped to reduce credit risk of the securities in the fixed income portfolio. The Board reviewed SMH’s practices for monitoring compliance with the Fund’s investment limitations. The Board mentioned that SMH has a strong compliance program in place. The Board acknowledged that SMH previously reported no material compliance issues or cybersecurity incidents. The Board observed that SMH noted that it had not

| 11 |

been involved in any material litigation since the Board last reviewed its sub-advisory agreement. The Board agreed that SMH had the experience and resources to provide quality services to the Fund.

Performance. The Board reviewed the performance information provided by SMH. The Board observed that the portion of the Fund portfolio that has been sub-advised by SMH outperformed the peer Morningstar category for the 1-, 3-, and 5-year periods. The Board concluded SMH had the ability to provide favorable returns to shareholders.

Fees and Expenses. The Board observed that SMH would receive 50% of the 1.75% advisory fee for the existing assets of the Fund and 28.57% of the advisory fee on new assets in the Fund. The Board discussed the allocation of fees between Catalyst and SMH in relation to their respective responsibilities and believed the allocation was appropriate. The Board concluded that the proposed sub-advisory fee was not unreasonable.

Profitability. The Board reviewed the profitability analysis provided by SMH and observed that SMH anticipated realizing a profit in both year 1 and year 2 of sub-advising the Fund. The Board discussed that it believed the projected profits were reasonable. The Board considered other potential benefits SMH would receive, including soft dollars arrangements. After further discussion, the Board agreed that the projected profits were not excessive.

Economies of Scale. The Board discussed whether there would be economies of scale with respect to the management of SMH. The Board agreed that this was primarily an advisor-level issue and had been considered with respect to the overall advisory agreement, taking into consideration the impact of the sub-advisory expense. The Board suggested that it would negotiate breakpoints in the future, if circumstances were appropriate.

Conclusion. Having requested and received such information from SMH as the Board believed to be reasonably necessary to evaluate the terms of the sub-advisory agreement, and as assisted by the advice of counsel, the Board concluded that the fee structure was reasonable, and that approval of the sub-advisory agreement was in the best interests of the future shareholders of the Fund.

The Board of Trustees of the Trust recommends that shareholders of the Fund vote “FOR” approval of Proposal I.

OTHER INFORMATION

The Fund is a diversified series of Mutual Fund Series Trust, an open-end investment management company organized as an Ohio business trust and formed by an Agreement and Declaration of Trust on March 17, 2006. The Trust’s principal executive offices are located at 4221 North 203rd Street, Suite 100, Elkhorn, Nebraska 68022. The Board supervises the business activities of the Fund. Like other mutual funds, the Fund retains various organizations to perform specialized services. The Fund has retained Catalyst as investment advisor and SMHCA as sub-advisor. Northern Lights Distributors, LLC, located at 4221 North 203rd Street, Suite 100, Elkhorn, Nebraska 68022, serves as national distributor of the Fund. MFund Services LLC, located at 36 North New York Avenue, Huntington, New York 11743, provides the Trust with certain management, and legal administrative services and compliance services. Ultimus Fund Solutions, LLC, with principal offices located

| 12 |

at 4221 North 203rd Street, Suite 100, Elkhorn, Nebraska 68022, provides the Fund with transfer agent, accounting, compliance, and administrative services.

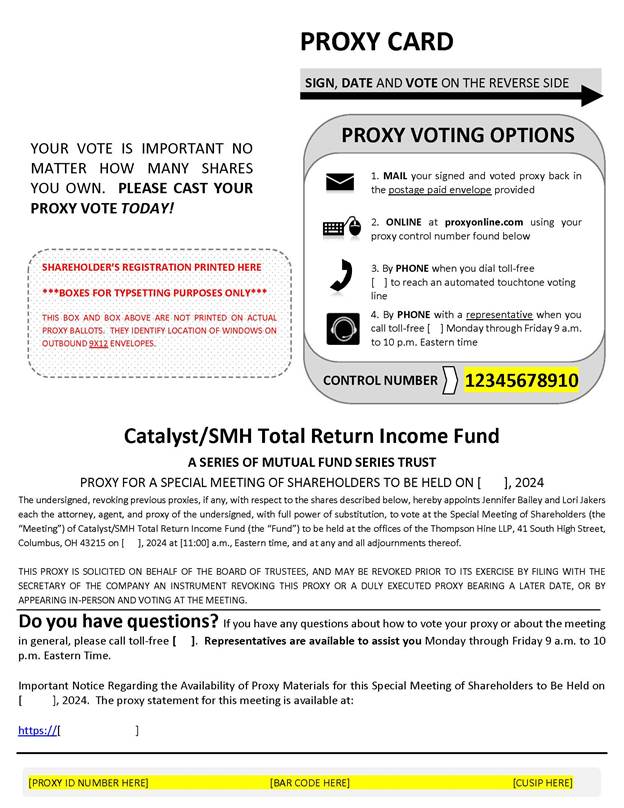

THE PROXY

The Board solicits proxies so that each shareholder has the opportunity to vote on the proposal to be considered at the Meeting. A proxy for voting your shares at the Meeting is enclosed. The shares represented by each valid proxy received in time will be voted at the Meeting as specified. If no specification is made, the shares represented by a duly executed proxy will be voted for approval of the proposed New Agreement and at the discretion of the holders of the proxy on any other matter that may come before the meeting that the Trust did not have notice of a reasonable time prior to the mailing of this Proxy Statement. You may revoke your proxy at any time before it is exercised by: (1) submitting a duly executed proxy bearing a later date; (2) submitting a written notice to the President of the Trust revoking the proxy; or (3) attending and voting in person at the Meeting.

VOTING SECURITIES AND VOTING

As of the Record Date, shares of beneficial interest of the Fund were issued and outstanding as follows:

| Class A | Class C | Class I | Total |

| 1,233,870.5220 | 568,109.4340 | 1,937,805.9110 | 3,739,785.8670 |

All shareholders of record of the Fund on the Record Date are entitled to vote at the Meeting on Proposal I with respect to the Fund. Each shareholder is entitled to one (1) vote per share held, and fractional votes for fractional shares held, on any matter submitted to a vote at the Meeting. There are no dissenters’ rights of appraisal in connection with any shareholder vote to be taken at the Meeting.

An affirmative vote of the holders of a majority of the outstanding shares of the Fund is required for the approval of the proposed New Advisory Fee with respect to the Fund. As defined in the 1940 Act, a vote of the holders of a majority of the outstanding shares of the Fund means the vote of: (1) 67% or more of the voting shares of the Fund present at the Meeting, if the holders of more than 50% of the outstanding shares of the Fund are present in person or represented by proxy; or (2) more than 50% of the outstanding voting shares of the Fund, whichever is less.

When a proxy is returned as an abstention, or “broker non-vote” (i.e., shares held by brokers or nominees, typically in “street name,” as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter), the shares represented by the proxy will be treated as present for purposes of determining a quorum and as votes against Proposal I. In addition, under the rules of the New York Stock Exchange (“NYSE”), if a NYSE-member broker has not received instructions from beneficial owners or persons entitled to vote and the proposal to be voted upon may “affect substantially” a shareholder’s rights or privileges, the broker may not vote the shares as to that proposal even if it has discretionary voting power.power (“broker non-votes”). In addition, the broker is not permitted to deliver a proxy with respect to such beneficial owner’s shares, and accordingly, such shares will not count as present for quorum purposes or for purses of §2(a)(42) of the 1940 Act. The NYSE considers Proposal I to be a non-routine matter that substantially affects a shareholder’s rights or privileges. As a result, there should be no broker non-votes delivered to the Fund, and these shares also will not be treated as broker non-votescounted for purposes of a vote on Proposal I, (but will not be treated as broker non-votes forquorum or any other proposals, including adjournment of the special meeting).purpose.

| 13 |

Treating broker non-votes as votes against Proposal I may result in the proposal not being approved, even though the votes cast in favor would have been sufficient to approve the proposal if some or all of the broker non-votes had been withheld.

Security Ownership of Management AND Certain Beneficial Owners

To the best knowledge of the Trust, there were no Trustees or officers of the Trust who were the beneficial owners of more than 5% of the outstanding shares of the Fund on the Record Date. Shareholders owning more than 25% of the shares of a Fund are considered to “control” the Fund, as that term is defined under the 1940 Act. As of the Record Date, the Trust is not aware of any shareholder owning more than 25% of the shares of the Fund.

As of the Record Date, the record owners of more than 5% of any outstanding class of shares of the Fund are listed in the following tables.

Class A Shares

| Name and Address of Beneficial or Record Owner | Number of Record and Beneficial (Shares) | Percent (%) of Class |

LPL Financial 4707 Executive Drive San Diego, CA 92121 | 107,416.4980 | 8.71% |

Wells Fargo Clearing Services LLC/Special Custody Account for the Exclusive Benefit of Customer 2801 Market Street Saint Louis, MO 63103 | 881,934.6160 | 71.48%* |

*May be deemed to control Class A shares of the Fund because it holds more than 25% of the outstanding Class A shares.

As of the Record Date, securities of the Fund’s Class A shares owned by all officers and trustees, including beneficial ownership, as a group represented less than 1% of the outstanding Class A shares of the Fund.

Class C Shares

| Name and Address of Beneficial or Record Owner | Number of Record and Beneficial (Shares) | Percent (%) of Class |

LPL Financial 4707 Executive Drive San Diego, CA 92121 | 94,119.6020 | 16.57% |

Raymond James Attn: Courtney Waller 880 Carillon Parkway Saint Petersburg, FL 33716 | 39,986.7560 | 7.04% |

Wells Fargo Clearing Services LLC/Special Custody Account for the Exclusive Benefit of Customer 2801 Market Street Saint Louis, MO 63103 | 269,638.8710 | 47.46%* |

American Enterprise A/C 8574-0070 707 2nd Avenue South Minneapolis, MN 55402 | 34,313.3100 | 6.04% |

*May be deemed to control Class C shares of the Fund because it holds more than 25% of the outstanding Class C shares.

As of the Record Date, securities of the Fund’s Class C shares owned by all officers and trustees, including beneficial ownership, as a group represented less than 1% of the outstanding Class C shares of the Fund.

Class I Shares

| Name and Address of Beneficial or Record Owner | Number of Record and Beneficial (Shares) | Percent (%) of Class |

Wells Fargo Clearing Services LLC/Special Custody Account for the Exclusive Benefit of Customer 2801 Market Street Saint Louis, MO 63103 | 714,574.6720 | 36.88%* |

Charles Schwab & Co., Inc. 211 Main Street San Francisco, CA 94105 | 1,097,017.6010 | 56.61%* |

*May be deemed to control Class I shares of the Fund because it holds more than 25% of the outstanding Class I shares.

As of the Record Date, securities of the Fund’s Class I shares owned by all officers and trustees, including beneficial ownership, as a group represented less than 1% of the outstanding Class I shares of the Fund.

SHAREHOLDER PROPOSALS

The Trust has not received any shareholder proposals to be considered for presentation at the Meeting. Under the proxy rules of the U.S. Securities and Exchange Commission, shareholder proposals may, under certain conditions, be included in the Trust’s Proxy Statement and proxy for a particular meeting. Under these rules, proposals submitted for inclusion in the Trust’s proxy materials must be received by the Trust within a reasonable time before the solicitation is made. The fact that the Trust receives a shareholder proposal in a timely manner does not ensure its inclusion in its proxy materials because there are other requirements in the proxy rules relating to such inclusion. You should be aware that annual meetings of shareholders are not required as long as there is no particular requirement under the 1940 Act, which must be met by convening such a shareholder meeting. Any shareholder proposal should be sent to Michael Schoonover, President, Mutual Fund Series Trust, 4221 North 203rd Street, Suite 100, Elkhorn, Nebraska 68022.

| 15 |

COST OF SOLICITATION

The Board is making this solicitation of proxies. The Trust has engaged [EQEQ Fund Solutions],Solutions, a proxy solicitation firm, to assist in the solicitation. The Fund will bear the cost of preparing and mailing this Proxy Statement, the accompanying Notice of Special Meeting and proxy and any additional materials relating to the meeting and the cost of soliciting proxies. In addition to solicitation by mail, the Trust will request banks, brokers and other custodial nominees and fiduciaries to supply proxy materials to the respective beneficial owners of shares of the Fund of whom they have knowledge. Certain officers, employees and agents of the Trust and Catalyst may solicit proxies in person or by telephone, facsimile transmission, or mail, for which they will not receive any special compensation. The estimated fees anticipated to be paid to the proxy solicitor are approximately $[_____].$9,000. The proxy solicitor will prepare and mail the Proxy Statement, Notice of Special Meeting and all materials relating to the meeting to each of the Fund’s shareholders, and will solicit and tabulate votes of the Fund’s shareholders.

OTHER MATTERS

The Board knows of no other matters to be presented at the Meeting other than as set forth above. If any other matters properly come before the Meeting that the Trust did not have notice of a reasonable time prior to the mailing of this Proxy Statement, the holders of the proxy will vote the shares represented by the proxy on such matters in accordance with their best judgment, and discretionary authority to do so is included in the proxy.

PROXY DELIVERY

If you and another shareholder share the same address, the Trust may only send one Proxy Statement unless you or any of the other shareholders requests otherwise. Call or write to the Trust if you wish to receive a separate copy of the Proxy Statement, and the Trust will promptly mail a copy

to you. You may also call or write to the Trust if you wish to receive a separate proxy in the future or if you are receiving multiple copies now and wish to receive a single copy in the future. For such requests, call the Trust toll-free at 1-855-552-4596,1-866-447-4228, or write the Trust at 4221 North 203rd Street, Suite 100, Elkhorn, NE 68022.

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to be Held on [____ __],June 4, 2024

A copy of the Notice of Shareholder Meeting, the Proxy Statement, and Proxy Card are available at [insert link]https://vote.proxyonline.com/catalyst/docs/proxy.pdf.

BY ORDER OF THE BOARD OF TRUSTEES

Michael Schoonover, President

Dated: [____ __],April 26, 2024

If you have any questions before you vote, please call our proxy information line at 1-800-628-8536800- 967-5019. Representatives are available Monday through Friday 9 a.m. to 10 p.m., Eastern Time to answer your questions about the proxy material or about how to how to cast your vote. You may also receive a

| 16 |

telephone call reminding you to vote your shares. Thank you for your participation in this important initiative.

Please: (i) COMPLETE the enclosed proxy and return it in the enclosed reply envelope SO THAT IT IS RECEIVED BY THE DATE SET BY THE FINANCIAL INTERMEDIARY THROUGH WHICH YOU OWN SHARES OF THE FUND OR, IF NO SUCH DATE IS SET, BY THE BEGINNING OF THE MEETING; OR (ii) Call the number listed on your proxy card BEFORE THE MEETING.

Exhibit A

INVESTMENT ADVISORY AGREEMENT

[INSERT AGREEMENT WITH REVISED FEE SCHEDULE]

TO: Catalyst Capital Advisors LLC

53 Palmeras St., Suite 601,

San Juan, PR 00901

Dear Sirs:

Mutual Fund Series Trust (the “Trust”) herewith confirms our agreement with you.

The Trust has been organized to engage in the business of an open-end management investment company. The Trust currently offers several series of shares to investors.

You have been selected to act as the sole investment adviser of the series of the Trust set forth on the Exhibits to this Agreement (each, a “Fund,” collectively, the “Funds”) and to provide certain other services, as more fully set forth below, and you are willing to act as such investment adviser and to perform such services under the terms and conditions hereinafter set forth. Accordingly, the Trust agrees with you as follows effective upon the date of the execution of this Agreement.

1. ADVISORY SERVICES

Subject to the supervision of the Board of Trustees of the Trust, you will provide or arrange to be provided to each Fund such investment advice as you in your discretion deem advisable and will furnish or arrange to be furnished a continuous investment program for each Fund consistent with the Fund’s investment objective and policies. You will determine or arrange for others to determine the securities to be purchased for each Fund, the portfolio securities to be held or sold by each Fund and the portion of each Fund’s assets to be held uninvested, subject always to the Fund’s investment objective, policies and restrictions, as each of the same shall be from time to time in effect, and subject further to such policies and instructions as the Board may from time to time establish. You will furnish such reports, evaluations, information or analyses to the Trust as the Board of Trustees of the Trust may request from time to time or as you may deem to be desirable. You also will advise and assist the officers of the Trust in taking such steps as are necessary or appropriate to carry out the decisions of the Board and the appropriate committees of the Board regarding the conduct of the business of the Trust.

2. USE OF SUB-ADVISERS

You may delegate any or all of the responsibilities, rights or duties described above to one or more sub-advisers who shall enter into agreements with you, provided the agreements are approved and ratified (i) by the Board including a majority of the trustees who are not interested persons of you or of the Trust, cast in person at a meeting called for the purpose of voting on such approval, and (ii) if required under interpretations of the Investment Company Act of 1940, as amended (the “Act”) by the Securities and Exchange Commission or its staff, by vote of the holders of a majority of the outstanding voting securities of the applicable Fund (unless the Trust has obtained an exemption from the provisions of Section 15(a) of the Act). Any such delegation shall not relieve you from any liability hereunder.

3. ALLOCATION OF CHARGES AND EXPENSES

You will pay the compensation of any sub-adviser retained pursuant to paragraph 2 above.

Each Fund will be responsible for the payment of all operating expenses of the Fund, including the compensation and expenses of any employees, officers and trustees of the Trust and of any other persons rendering any services to the Fund; clerical and shareholder service staff salaries; office space and other office expenses; fees and expenses incurred by the Fund in connection with membership in investment company organizations; legal, auditing and accounting expenses; expenses of registering shares under federal and state securities laws, including expenses incurred by the Fund in connection with the organization and initial registration of shares of the Fund; insurance expenses; fees and expenses of the custodian, transfer agent, dividend disbursing agent, shareholder service agent, plan agent, administrator, accounting and pricing services agent and underwriter of the Fund; expenses, including clerical expenses, of issue, sale, redemption or repurchase of shares of the Fund; the cost of preparing and distributing reports and notices to shareholders, the cost of printing or preparing prospectuses and statements of additional information for delivery to shareholders; the cost of printing or preparing stock certificates or any other documents, statements or reports to shareholders; expenses of shareholders’ meetings and proxy solicitations; advertising, promotion and other expenses incurred directly or indirectly in connection with the sale or distribution of the Fund’s shares that the Fund is authorized to pay pursuant to Rule 12b-1 under the Act; and all other operating expenses not specifically assumed by you. Each Fund will also pay all brokerage fees and commissions, taxes, borrowing costs (such as (a) interest and (b) dividend expenses on securities sold short), fees and expenses of the non-interested person Trustees and such extraordinary or non-recurring expenses as may arise, including regulatory examinations, and litigation to which the Fund may be a party and indemnification of the Trust’s Trustees and officers with respect thereto.

You may obtain reimbursement from each Fund, at such time or times as you may determine in your sole discretion, for any of the expenses advanced by you, which the Fund is obligated to pay, and such reimbursement shall not be considered to be part of your compensation pursuant to this Agreement.

4. COMPENSATION OF THE ADVISER

For all of the services to be rendered as provided in this Agreement, as of the last business day of each month, each Fund will pay you a fee based on the average value of the daily net assets of the Fund and paid at an annual rate as set forth on the Exhibit executed with respect to such Fund and attached hereto.

The average value of the daily net assets of a Fund shall be determined pursuant to the applicable provisions of the Agreement and Declaration of Trust or a resolution of the Board of Trustees, if required. If, pursuant to such provisions, the determination of net asset value of a Fund is suspended for any particular business day, then for the purposes of this paragraph, the value of the net assets of the Fund as last determined shall be deemed to be the value of the net assets as of the close of the business day, or as of such other time as the value of the Fund’s net assets may lawfully be determined, on that day. If the determination of the net asset value of a Fund has been suspended for a period including such month, your compensation payable at the end of such month shall be computed on the basis of the value of the net assets of the Fund as last determined (whether during or prior to such month).

| 19 |

5. EXECUTION OF PURCHASE AND SALE ORDERS

In connection with purchases or sales of portfolio securities for the account of a Fund, it is understood that you (or the applicable sub-adviser retained pursuant to paragraph 2 above) will arrange for the placing of all orders for the purchase and sale of portfolio securities for the account with brokers or dealers selected by you (or the sub-adviser), subject to review of this selection by the Board of Trustees from time to time. You (or the sub-adviser) will be responsible for the negotiation and the allocation of principal business and portfolio brokerage. In the selection of such brokers or dealers and the placing of such orders, you (or the sub-adviser) are directed at all times to seek for the Funds the best qualitative execution, taking into account such factors as price (including the applicable brokerage commission or dealer spread), the execution capability, financial responsibility and responsiveness of the broker or dealer and the brokerage and research services provided by the broker or dealer.

You (or the sub-adviser) should generally seek favorable prices and commission rates that are reasonable in relation to the benefits received. In seeking best qualitative execution, you (or the sub-adviser) are authorized to select brokers or dealers who also provide brokerage and research services to the Fund and/or the other accounts over which you exercise investment discretion. You (or the sub-adviser) are authorized to pay a broker or dealer who provides such brokerage and research services a commission for executing a Fund portfolio transaction which is in excess of the amount of commission another broker or dealer would have charged for effecting that transaction if you (or the sub-adviser) determine in good faith that the amount of the commission is reasonable in relation to the value of the brokerage and research services provided by the executing broker or dealer. The determination may be viewed in terms of either a particular transaction or your (or the sub-adviser’s) overall responsibilities with respect to the Fund and to accounts over which you (or the sub-adviser) exercise investment discretion. The Funds and you (and the sub-adviser) understand and acknowledge that, although the information may be useful to the Funds and you (and the sub-adviser), it is not possible to place a dollar value on such information. The Board of Trustees shall periodically review the commissions paid by each Fund to determine if the commissions paid over representative periods of time were reasonable in relation to the benefits to the Fund.

A broker’s or dealer's sale or promotion of Fund shares shall not be a factor considered by your personnel responsible for selecting brokers to effect securities transactions on behalf of the Fund. You and your personnel shall not enter into any written or oral agreement or arrangement to compensate a broker or dealer for any promotion or sale of Fund shares by directing to such broker or dealer (i) the Fund's portfolio securities transactions or (ii) any remuneration, including but not limited to, any commission, mark-up, mark down or other fee received or to be received from the Fund's portfolio transactions through such broker or dealer. However, you may place Fund portfolio transactions with brokers or dealers that sell or promote shares of the Fund provided the Board of Trustees has adopted policies and procedures under Rule 12b-1(h) under the Act and such transactions are conducted in compliance with those policies and procedures.

Subject to the provisions of the Act, and other applicable law, you (or the sub-adviser), any of your (and the sub-adviser’s) affiliates or any affiliates of your (or the sub-adviser’s) affiliates may retain compensation in connection with effecting a Fund’s portfolio transactions, including transactions effected through others. If any occasion should arise in which you (or the sub-adviser) give any advice to your clients (or clients of the sub-adviser) concerning the shares of a Fund, you (or the sub-adviser) will act solely as investment counsel for such client and not in any way on behalf of the Fund.

| 20 |

6. PROXY VOTING

You will vote, or make arrangements to have voted, all proxies solicited by or with respect to the issuers of securities in which assets of the Funds may be invested from time to time. Such proxies will be voted in a manner that you deem, in good faith, to be in the best interest of the Funds and in accordance with your proxy voting policy. You agree to provide a copy of your proxy voting policy, and any amendments thereto, to the Trust prior to the execution of this Agreement

7. CODE OF ETHICS

You have adopted a written code of ethics complying with the requirements of Rule 17j-1 under the Act and will provide the Trust with a copy of the code and evidence of its adoption. Within 60 days of the last calendar quarter of each year while this Agreement is in effect, you will provide to the Board of Trustees of the Trust a written report that describes any issues arising under the code of ethics since the last report to the Board of Trustees, including, but not limited to, information about material violations of the code and sanctions imposed in response to the material violations; and which certifies that you have adopted procedures reasonably necessary to prevent access persons (as that term is defined in Rule 17j-1) from violating the code.

8. SERVICES NOT EXCLUSIVE/USE OF NAME

Your services to a Fund pursuant to this Agreement are not to be deemed to be exclusive, and it is understood that you may render investment advice, management and other services to others, including other registered investment companies, provided, however, that such other services and activities do not, during the term of this Agreement, interfere in a material manner, with your ability to meet all of your obligations with respect to rendering services to the Funds.

The Trust and you acknowledge that all rights to the name “Catalyst” or any variation thereof belong to you, and that the Trust is being granted a limited license to use such words in its Fund name or in any class name. In the event you cease to be the adviser to the Fund, the Trust’s right to the use of the name “Catalyst” shall automatically cease on the ninetieth day following the termination of this Agreement. The right to the name may also be withdrawn by you during the term of this Agreement upon ninety (90) days’ written notice by you to the Trust. Nothing contained herein shall impair or diminish in any respect, your right to use the name “Catalyst” in the name of, or in connection with, any other business enterprises with which you are or may become associated. There is no charge to the Trust for the right to use this name.

9. LIMITATION OF LIABILITY OF ADVISER

You may rely on information reasonably believed by you to be accurate and reliable. Except as may otherwise be required by the Act or the rules thereunder, neither you nor your directors, officers, employees, shareholders, members, agents, control persons or affiliates of any thereof shall be subject to any liability for, or any damages, expenses or losses incurred by the Trust in connection with, any error of judgment, mistake of law, any act or omission connected with or arising out of any services rendered under, or payments made pursuant to, this Agreement or any other matter to which this Agreement relates, except by reason of willful misfeasance, bad faith or gross negligence on the part of any such persons in the performance of your duties under this Agreement, or by reason of reckless disregard by any of such persons of your obligations and duties under this Agreement.

Any person, even though also a director, officer, employee, shareholder, member or agent of you, who may be or become a trustee, officer, employee or agent of the Trust, shall be deemed, when rendering services to the Trust or acting on any business of the Trust (other than services or business in connection

| 21 |

with your duties hereunder), to be rendering such services to or acting solely for the Trust and not as a director, officer, employee, shareholder, member, or agent of you, or one under your control or direction, even though paid by you.

10. DURATION AND TERMINATION OF THIS AGREEMENT

The term of this Agreement shall begin on the date of this Agreement for each Fund that has executed an Exhibit hereto as of the date of this Agreement and shall continue in effect with respect to each such Fund (and any subsequent Fund added pursuant to an Exhibit executed during the initial two-year term of this Agreement) for a period of two (2) years. This Agreement shall continue in effect from year to year thereafter, subject to termination as hereinafter provided, if such continuance is approved at least annually by (a) a majority of the outstanding voting securities of such Fund or by vote of the Trust’s Board of Trustees, cast in person at a meeting called for the purpose of voting on such approval, and (b) by vote of a majority of the Trustees of the Trust who are not parties to this Agreement or “interested persons” of any party to this Agreement, cast in person at a meeting called for the purpose of voting on such approval. If a Fund is added pursuant to an Exhibit executed after the date of this Agreement as described above, this Agreement shall become effective with respect to that Fund upon execution of the applicable Exhibit and shall continue in effect for a period of two years from the date thereof and from year to year thereafter, subject to approval as described above.

This Agreement may, on sixty (60) days written notice, be terminated with respect to the Fund, at any time without the payment of any penalty, by the Board of Trustees, by a vote of a majority of the outstanding voting securities of the Fund, or by you. This Agreement shall automatically terminate in the event of its assignment.

11. AMENDMENT OF THIS AGREEMENT

No provision of this Agreement may be changed, waived, discharged or terminated orally, and no amendment of this Agreement shall be effective until approved by the Board of Trustees, including a majority of the Trustees who are not interested persons of you or of the Trust, cast in person at a meeting called for the purpose of voting on such approval, and (if required under interpretations of the Act by the Securities and Exchange Commission or its staff) by vote of the holders of a majority of the outstanding voting securities of the Fund to which the amendment relates.

12. LIMITATION OF LIABILITY TO TRUST PROPERTY

The term “Mutual Fund Series Trust” means and refers to the Trustees from time to time serving under the Trust’s Agreement and Declaration of Trust as the same may subsequently thereto have been, or subsequently hereto be, amended. It is expressly agreed that the obligations of the Trust hereunder shall not be binding upon any of Trustees, officers, employees, agents or nominees of the Trust, or any shareholders of any series of the Trust, personally, but bind only the trust property of the Trust (and only the property of the applicable Fund), as provided in the Agreement and Declaration of Trust. The execution and delivery of this Agreement have been authorized by the Trustees and shareholders of the applicable Fund and signed by officers of the Trust, acting as such, and neither such authorization by such Trustees and shareholders nor such execution and delivery by such officers shall be deemed to have been made by any of them individually or to impose any liability on any of them personally, but shall bind only the trust property of the Trust (and only the property of applicable Fund) as provided in its Agreement and Declaration of Trust. A copy of the Agreement and Declaration of Trust is on file with the Secretary of State of Ohio.

| 22 |

13. SEVERABILITY

In the event any provision of this Agreement is determined to be void or unenforceable, such determination shall not affect the remainder of this Agreement, which shall continue to be in force.

14. BOOKS AND RECORDS

In compliance with the requirements of Rule 31a-3 under the Act, you agree that all records which you maintain for the Trust are the property of the Trust and you agree to surrender promptly to the Trust such records upon the Trust’s request. You further agree to preserve for the periods prescribed by Rule 31a-2 under the Act all records which you maintain for the Trust that are required to be maintained by Rule 31a-1 under the Act.

15. QUESTIONS OF INTERPRETATION

(a) This Agreement shall be governed by the laws of the State of New York.

(b) For the purpose of this Agreement, the terms “assignment,” “majority of the outstanding voting securities,” “control” and “interested person” shall have their respective meanings as defined in the Act and rules and regulations thereunder, subject, however, to such exemptions as may be granted by the Securities and Exchange Commission under the Act; and the term “brokerage and research services” shall have the meaning given in the Securities Exchange Act of 1934.

(c) Any question of interpretation of any term or provision of this Agreement having a counterpart in or otherwise derived from a term or provision of the Act shall be resolved by reference to such term or provision of the Act and to interpretation thereof, if any, by the United States courts or in the absence of any controlling decision of any such court, by the Securities and Exchange Commission or its staff. In addition, where the effect of a requirement of the Act, reflected in any provision of this Agreement, is revised by rule, regulation, order or interpretation of the Securities and Exchange Commission or its staff, such provision shall be deemed to incorporate the effect of such rule, regulation, order or interpretation.

16. NOTICES

Whenever any notice is required or permitted to be given under any provision of this Agreement, such notice shall be in writing, shall be signed by or on behalf of the party giving the notice and shall be mailed by first class or express mail, or sent by courier, or email to the other party at the mailing addresses, or email addresses specified below or to such other address as a party may from time to time specify to the other party by such notice hereunder. Any such notice shall be deemed duly given when delivered at such address.

If to the Trust:

| JoAnn Strasser, Esq |

| Thompson Hine LLP |

| 41 South High Street, Suite 1700 |

| Columbus, Ohio 43215-6101 |

| JoAnn.Strasser@ThompsonHine.com |

If to Catalyst Capital Advisors LLC:

Jerry Szilagyi Chief Executive Officer Catalyst Capital Advisors LLC |

| 53 Palmeras St., Suite 601, |

| San Juan, PR 00901 |

Email:JerryS@catalystmutualfunds.com |

17. CONFIDENTIALITY

You agree to treat all records and other information relating to the Trust and the securities holdings of a Fund as confidential and shall not disclose any such records or information to any other person unless (i) the Board of Trustees of the Trust has approved the disclosure or (ii) such disclosure is compelled by law. In addition, you, and your officers, directors and employees are prohibited from receiving compensation or other consideration, for themselves or on behalf of a Fund, as a result of disclosing the Fund’s portfolio holdings. You agree that, consistent with your Code of Ethics, neither you nor your officers, directors or employees may engage in personal securities transactions based on nonpublic information about the Fund's portfolio holdings.

18. COUNTERPARTS

This Agreement may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

19. BINDING EFFECT

Each of the undersigned expressly warrants and represents that he has the full power and authority to sign this Agreement on behalf of the party indicated, and that his signature will operate to bind the party indicated to the foregoing terms.

20. CAPTIONS

The captions in this Agreement are included for convenience of reference only and in no way define or delimit any of the provisions hereof or otherwise affect their construction or effect.

If you are in agreement with the foregoing, please sign the form of acceptance on the accompanying counterpart of this letter and return such counterpart to the Trust, whereupon this letter shall become a binding contract upon the date thereof.

Yours very truly,

Mutual Fund Series Trust

Dated: as of [ ], 2024

By:

Print Name: [ ]

Title: Trustee

ACCEPTANCE:

The foregoing Agreement is hereby accepted.

| 24 |

Catalyst Capital Advisors LLC

Dated: as of [ ], 2024

By:

Print Name: Jerry Szilagyi

Title: Chief Executive Officer

| 25 |

Exhibit 1

| Percentage of Average | |||

| Fund | Daily Net Assets | ||

| Catalyst/SMH Systematic High Income Fund | 1.75% |

| 26 |

Exhibit B

SUB-ADVISORY AGREEMENT